The other day, my wife received a inhabitant tax payment slip from the city office.

My wife started working the year before last, but the first year she worked only a few months, so she was exempt from the tax. Last year, she worked for a full year, so she had to pay inhabitant tax.

While income tax and social insurance premiums are deducted from the year's salary, inhabitant tax is calculated based on the previous year's income. Therefore, this is the first time my wife has been subject to inhabitant tax payment.

My wife, who has always said, "Japan has high income tax and social insurance premiums," was so upset by the high inhabitant tax that she unintentionally uttered, "Japan idiot!

Therefore, I looked into income tax and inhabitant tax in the Philippines.

The table above shows taxable income and tax rates in the Philippines. There is no income tax on annual income up to 250,000 pesos. In monthly terms, this is approximately 20,000 pesos. It is said that many Filipinos whose monthly salary does not reach 20,000 pesos, so not so many may be paying income tax.

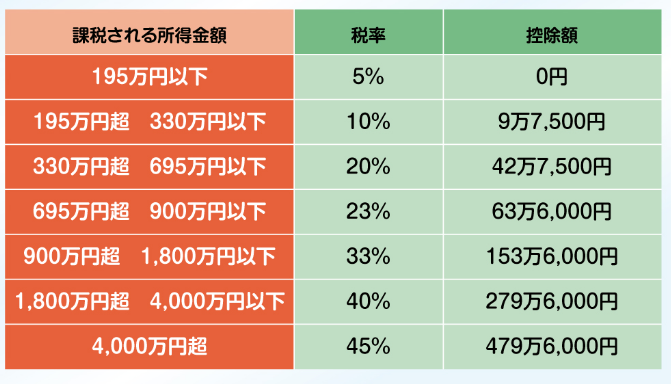

The table below shows Japanese income tax. Although the amount of income and tax rates differ, all countries use a progressive taxation system in which the tax rate rises in proportion to income.

Japanese income tax is calculated by multiplying income minus employment income deductions and basic deductions by the tax rate.

I have not checked at this time whether income in the Philippines has similar deductions.

Japan's inhabitant tax is calculated by multiplying the amount of income used to calculate income tax (called gross income) by the tax rate, minus the amount of income deductions such as insurance premiums (including social insurance) and basic deductions. The tax rate is 10%.

Roughly speaking, (income - salary deductions - income tax deductions) x 10% = inhabitant tax.

The Philippines also has something like an inhabitant tax called a community tax. However, it is much cheaper than in Japan.

The amount of tax is 5 pesos + additional community tax (annual gross income / 1000) pesos.

If your annual income is 500,000 pesos, the tax is (5 pesos + 500 pesos) = 505 pesos. That is only 1,260 Japanese yen. Incidentally, the annual community association fee for my family is 3,600 yen.

I can understand why my wife is surprised at the amount of Japanese inhabitant tax and wanted to say "Japan stupid!

However, the Philippine value-added tax (consumption tax in Japan) is 12%, while Japan's is 10% (8% for some items such as food), so Japan is a little cheaper.

However, I am reminded once again that social insurance premiums and taxes in Japan are high.