A couple of years ago, I started using very little cash.

The only time I use cash now is to charge my Suica card and to send money to my family in the Philippines.

At one time, I downloaded the Suica application for Apple Pay on my IPhone and used it for JAL credit card payments.

It was very convenient, and I didn't have to charge it at the station every time, so it was useful.

However, with this method, I cannot earn miles even though I am using my JAL card.

In particular, I instantly stopped using Apple Pay when I found out that I could get 1,500 miles when I bought a commuter pass with my JAL card at a ticket machine at the station, but no miles at all when I used Apple Pay.

The main reason I stopped using cash in earnest was that I could now use my card at the supermarket checkout counter.

I think this was also supported by the country's cashless point reduction campaign that started with the consumption tax hike in September 2019.

This campaign has enabled many places to accept credit cards, electronic money such as Suica, and electronic payments using smartphones.

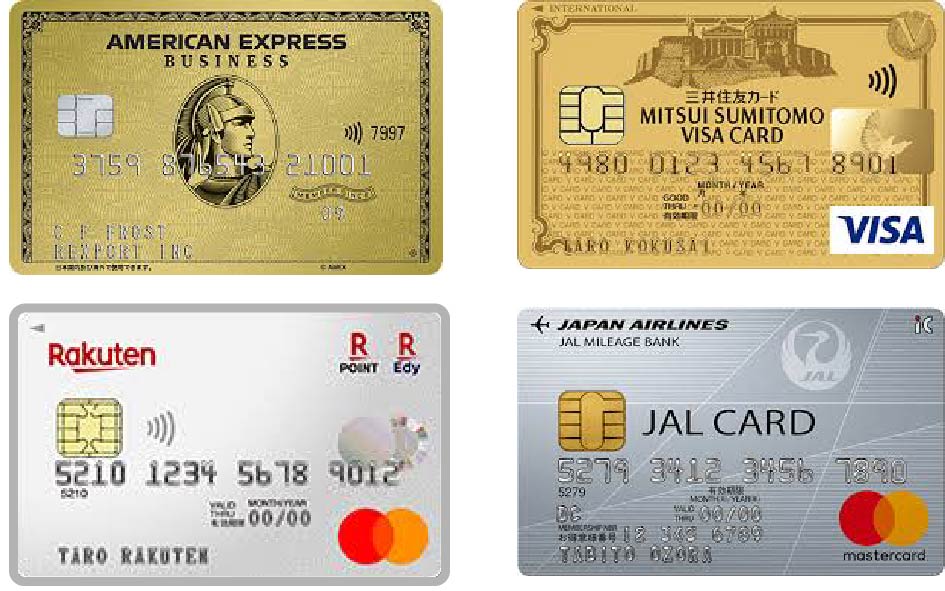

In my case, I use credit cards exclusively. This is because using a credit card has more advantages than cash.

Some, like the JAL card, allow you to earn miles and redeem them for free airline tickets when you pay for everyday purchases, and others, like the Amazon card, allow you to earn more points than normal so you can make substantially cheaper purchases.

In addition, there are other benefits such as insurance coverage in case something happens to you on your domestic or overseas trip.

I made a family card for my wife to have, and before she came to Japan, I could use my Rakuten card to cash out at ATMs in the Philippines without the hassle of sending money overseas.

Even now, my wife has several credit cards.

That's because it can be used without my presence at any time.

And when my wife signs a contract for a smartphone in Japan, My wife may need a credit card in wife's name.

So when I get a credit card, I avoid those that have high annual fees for family member cards.

Rakuten Card has no annual fee for both cardholders and family members.

I used to have a JAL Gold Card, but the annual fee for the family card was too high, so I switched to a regular card.

The American Express Gold Card is helpful because one family member's card is free.

The annual membership fee is 31,900 yen, which is not cheap, but there is a special offer called Dining Biyori (if you book a course at a restaurant, you get one person free, so if you use it three times a year, you can make up for the annual fee) and various campaigns.

It's not expensive when you consider the free airport lounges, etc.

By the way, I received a letter from American Express the other day.

The overseas travel accident insurance, which used to be partially automatic, will be applied only when you pay for your trip with your card from July 1, 2012.

In Japan, I think most people use the American Express card for travel rather than for everyday use. This is because there are very few places in Japan where AMEX is accepted.

It has been available at JCB member stores since 2000, but many people don't seem to know about it. I didn't know about it either.

The fact that the number of people traveling with Corona disasters is decreasing drastically may have led to the elimination of the automatic overseas travel accident insurance.

The year 2020 ends today, but this year, the Corona disaster has taken us far away from abroad.

I hope that in 2021, I will be able to go abroad freely again.