I received a sealed letter from the tax department of the Ryugasaki City Hall.

When I opened it, I found a tax payment slip for the city tax.

I had already received this year's tax notice from my part-time job, and I was happy to see that it was much cheaper this year, but it seems that it was only the tax related to my wages.

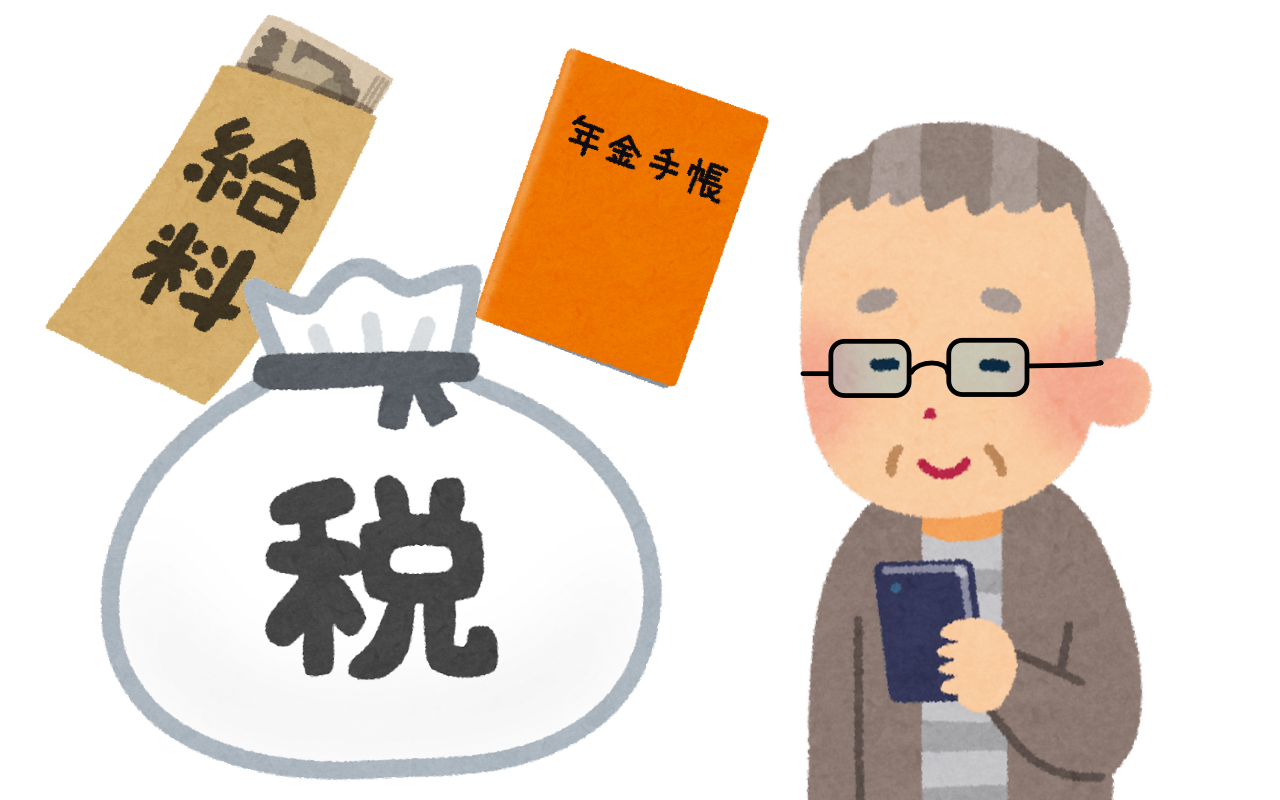

According to the notice, pension income is also subject to the citizen's tax, which is supposed to be specially collected from the pension. The tax must be paid directly in June and August.

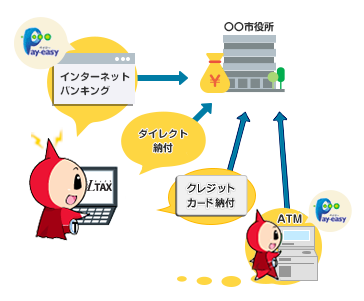

Payment can be made directly to the city hall, or at a bank, post office, or convenience store with a money transfer form, but recently it seems that payment can also be made from a smartphone. Since I could pay without going anywhere, I quickly scanned the QR code and made the payment.

I was happy to see a slight increase in my pension from April (actually, it was paid in June), but the world is not so easy, as I will have to pay inhabitant tax as well. Moreover, because of the increase in income, the nursing care insurance premiums for the current fiscal year will also increase by one level to 92,200 yen per year.

Although it is a national obligation, the burden of taxes and social insurance premiums is not insignificant. The government tries to raise taxes for any reason it can think of, but let us not forget that a decrease in disposable income will have a negative impact on the economy.