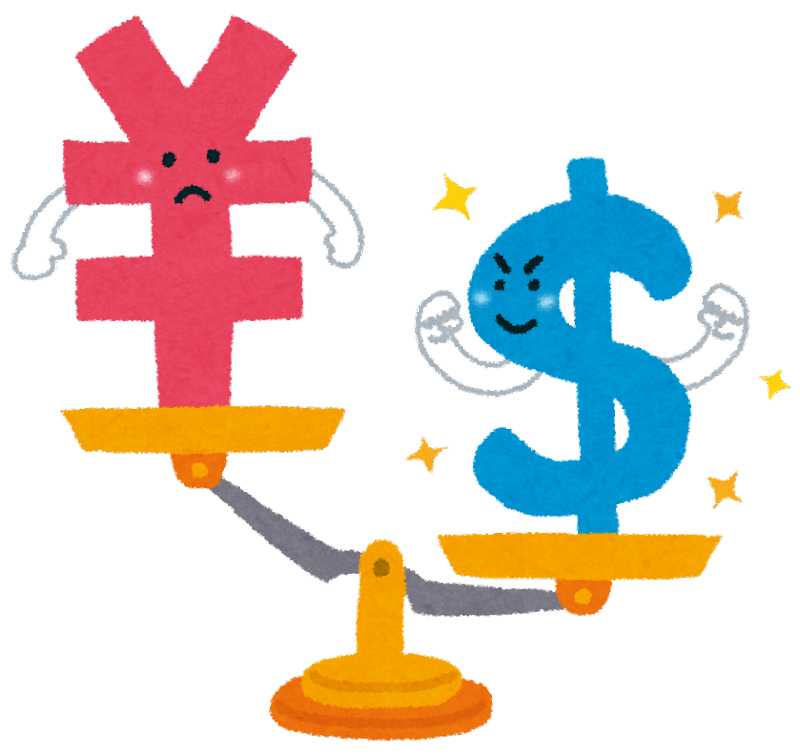

The yen continued to weaken this morning against the dollar at 122.34 yen per dollar.

Last month it was ¥115, which means that the value of the yen has dropped by ¥7, or nearly 6% at a rate of 6 yen per dollar.

The Philippine peso is also down about 6% against the yen, with the peso at ¥2.34.

Since inflation is also rising in the Philippines, we believe that the lives of migrants who rely on pensions as a source of funds are becoming more difficult.

I sends money to my wife's sister who takes care of our children so that she receives a fixed amount of Philippine pesos each month. So when the yen weakens, the amount of yen remitted increases.

We are now building a house in Cebu, but it is a headache because the cost will be more than 10% higher than before, not only because of the rising cost of materials, but also because of the weak yen.

Japan imports much of what is essential for daily life, such as fuel and food, from overseas. The weak yen has increased costs and prices of goods are slowly rising.

On the other hand, income is not increasing, so people's lives are becoming more difficult. Stagflation has already begun.

Bank of Japan Governor Kuroda has remained quiet about the yen's weakness due to the stagnant Japanese economy, and the Japanese government has shown no signs of taking any action.

It seems that the yen cannot stop depreciating for the time being.

In that case, it may be a wise use of money to buy mutual funds and dollars for worldwide investments as much as possible, instead of buying unnecessary things to protect our lives.