The value of the yen is dropping rapidly.

Finally, one dollar is now worth 126 yen.

In my blog on October 13 last year, I wrote that the yen was at 113 against the dollar, which was a bad yen depreciation because the yen was too cheap. Now it is 126 yen. If the yen continues at this rate, it will exceed 130 yen, and some say it may even reach 135 yen.

This depreciation of the yen is not only against the dollar, but also against the currencies of other countries. It is the yen's single largest depreciation.

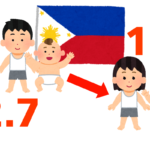

In the case of the Philippine peso, last year, 10,000 yen was roughly in the range of 4,500 to 4,600 pesos.

It is currently at 4,124 pesos.

My family sends a fixed amount of money (pesos) every month. Therefore, when the yen depreciates, it has a big impact.

Let's say we send 10,000 pesos. Last year, the amount was only 21,000 yen, but now it is 24,000 yen, an extra 3,000 yen.

Although the amount of money sent home is not that large (although it is quite tight throughout the year, and it is the same burden as sending home an extra month's worth of money), the cost of building a house is quite large, so it is very difficult.

The causes of the yen's depreciation are many and varied, and no one can give an exact answer.

It is said to be influenced by such factors as speculative yen selling and dollar buying, real demand (payments in foreign currencies for trade and foreign investments), and interest rate differentials with other countries.

Many people believe that it is better to buy U.S. stocks and other securities than those of domestic companies, especially when the economy is sluggish.

In fact, many individual investors bought investment trusts incorporating foreign stocks last year, amounting to more than 7 trillion yen. This means that the yen has sold off by that amount. This is another reason for the yen's depreciation.

The mutual funds I buy monthly are also a mix of US and European stocks and bonds.

In addition, I have a dollar savings account, which means that I sell yen every month, albeit in small amounts. Therefore, in terms of yen, the amount of assets is increasing.

For me personally, it is rational investment behavior. On the other hand, if many people think and act in the same way, it will have a major impact. In other words, it will cause the yen to depreciate, which many Japanese do not want.

This is probably called the fallacy of synthesis.

If the yen continues to weaken, we will be in serious trouble.