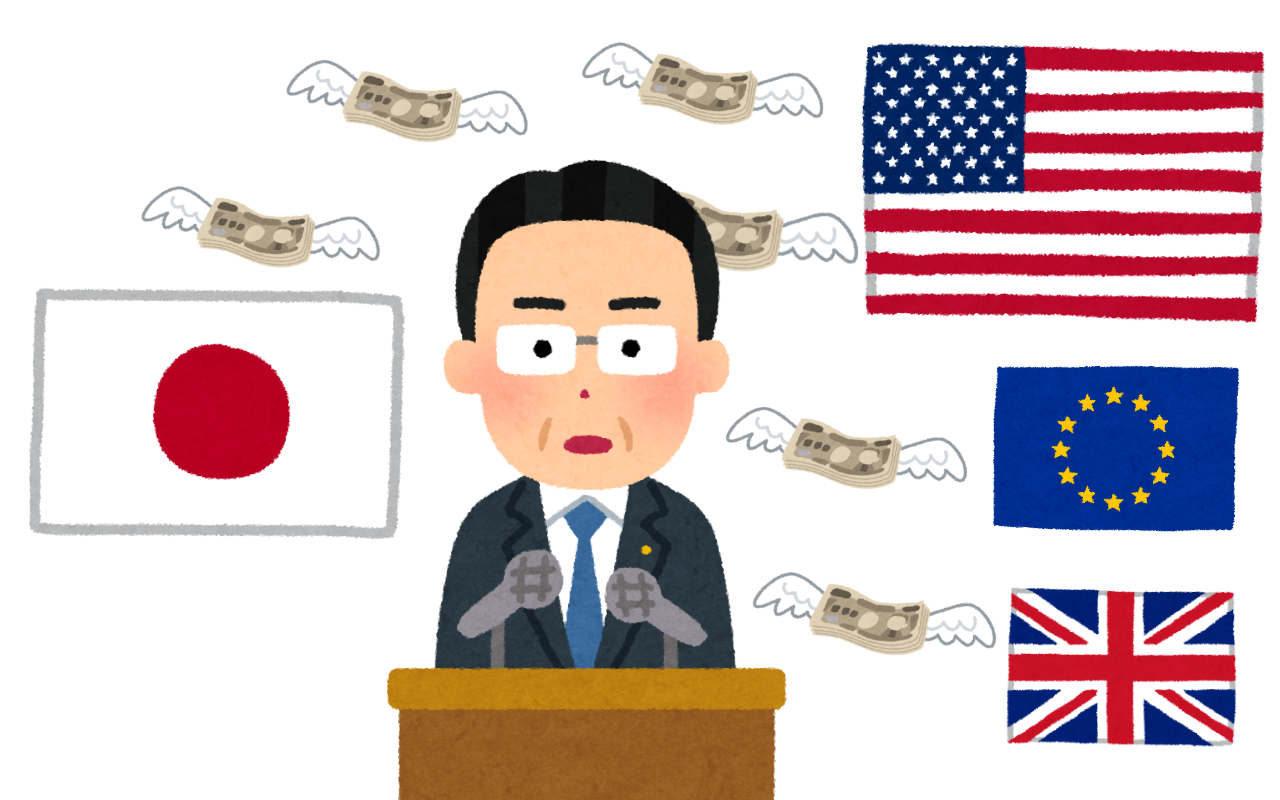

During his visit to London, Prime Minister Kishida gave a speech on the government's approach to the Japanese economy in the financial district City.

The Nikkei reported that the company will focus its efforts on the following four pillars

(1) Investment in people…Raise wages and increase job mobility by improving skills through job training and relearning.

(2) Investment in science and innovation…Strengthen incentives for companies working in national strategic fields such as artificial brains, quantum, and biotechnology

(3) Investment in startups…Creating an environment for a second postwar boom in business startups

(4) Investment in green and digital… Investment in restarting nuclear power plants and renewable energy, etc.

The plan is to realize this kind of investment through public-private partnerships.

The investment requires funds, and it is said that the private sector's financial assets are being relied upon for these funds.

Indeed, Japanese households have ¥2023 trillion in financial assets, and corporations have ¥320 trillion in savings as internal reserves.

Naturally, investments are made with the expectation of return. Will the Japanese people and companies really invest in something that offers no return no matter how much the government waves the flag?

The full text of the speech has not been released, so some points are unclear.

The PM is said to have said that the important stock aspect of investing in people is "saving to investing.

About half of the financial assets held by the Japanese are in savings accounts. With virtually no interest rates, these savings accounts generate nothing. He argues that shifting this to investment would lead to a doubling of financial assets.

As the prime minister says, the rise in U.S. stock prices over the past 10 years has tripled the financial assets of individual investors in the United States. However, investments can go up or down.

As financial assets increase, so does disposable income, some of which may be invested in people.

Personally, I welcome the drastic expansion of the small investment tax exemption (NISA) program. I think it is a good thing that it will increase future income from financial assets.

On the other hand, with Japan's economy stagnant, the investment destination has to be the U.S. or Europe.

The government should consider what would happen if even a portion of the 1,000 trillion yen in bank deposits and savings were to be invested.

Selling the yen and converting it to dollars or euros is still good enough to weaken the yen, but in some cases it may result in a sell-off of Japan.