This morning's Nikkei Shimbun reported in its electronic edition that Kirayaka Bank, headquartered in Yamagata City, was considering applying for public funds.

Kirayaka Bank has applied for public funds twice before, once after the Lehman Shock and once after the Great East Japan Earthquake.

While the two previous applications were due to unavoidable accidents, the reasons for this latest application are a true reflection of the current situation of Japanese banks.

The direct reason for the application for public funds was due to the decline in stock prices caused by the increase in interest rates by the U.S. Fed.

Unrealized losses on securities held by Kirayaka Bank have ballooned to 12.1 billion yen. This appears to have caused the bank's capital adequacy ratio to decline.

Unrealized gains on securities at regional banks are about 1.4 trillion yen, although 700 billion yen less than the previous year, which means that Kirayaka Bank has failed to invest in foreign bonds.

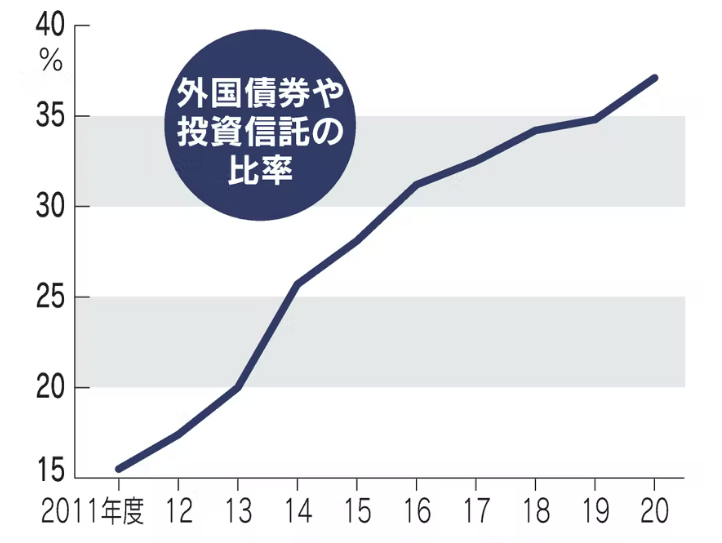

The graph above shows the percentage of foreign bonds in the securities held by the 100 regional banks.

Banks are financial institutions that are sustained by investing the deposits of their depositors. Therefore, they have been very prudent in their investment activities, taking as little risk as possible. Banks are known for their strict screening process for loans.

Despite the sluggish Japanese economy, bank deposits continue to grow. According to the Japanese Bankers Association, deposits at the end of last month (April 2022) were up 2.8% from last year to 883 trillion yen. Loans, on the other hand, totaled only 524 trillion yen.

The loan-to-deposit ratio, or loan-to-deposit ratio, is 59.3%.

One of the functions of banks is credit creation. This refers to the creation of credit money by lending deposits. Therefore, the higher the loan-to-deposit ratio, the better the bank is functioning.

Incidentally, the loan-to-deposit ratio was 71.4% 10 years ago and 67.7% five years ago, and it has been decreasing every year.

A small loan-to-deposit ratio means that there is little demand for funds from the businesses and households to which they lend.

Banks need to invest the money they receive in order to make a profit.

Traditionally, banks have invested their funds by purchasing government bonds or depositing them with the Bank of Japan, but the Bank of Japan's extraordinary easing has kept interest rates on government bonds low, and with the introduction of negative interest rates and other factors, banks no longer have a solid investment option, although it is less profitable.

Deposits continue to increase (up 286 trillion yen over the past 10 years), but the number of lenders is not increasing. They are also unable to generate investment profits from government bonds. Therefore, more and more banks are trying to earn profits by purchasing foreign bonds, despite the risks involved. This is clearly shown in the graph of the increase in foreign bonds.

Banks that can no longer make money in their core business are restructuring through consolidation, reducing the number of branches, ATMs, and employees. At the same time, they are trying to survive by cooperating with other banks.

As the Japanese economy shrinks and the population decreases, banks that cannot change their traditional business models will have to disappear.