I started with mutual funds in 2017.

At the time, I started without knowing anything about mutual funds, so I started accumulating them in a taxable account.

As for NISA, I didn't even know the difference between general NISA and savings NISA.

Since NISA started in 2014, I don't think the information was as current.

NISA is an account in which there is no tax on profits from investments. In a regular taxable account, there is a 20% tax on profits. For example, if you have 1,000,000 yen in gains from trading mutual funds, you will pay 200,000 yen in taxes, so the amount you actually get is only 800,000 yen. With NISA, however, you would have 1,000,000 yen in your pocket.

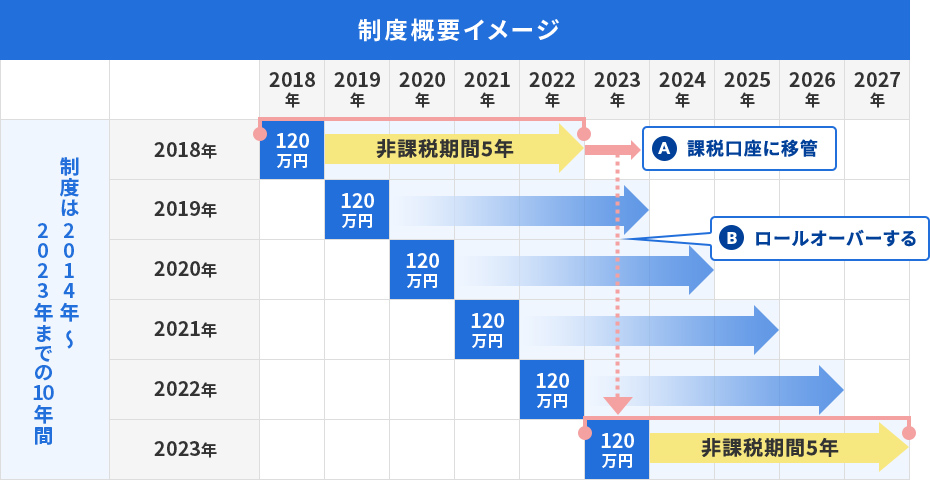

There are two types of NISA: general NISA and savings NISA. The tax exemption period for general NISA is five years, and up to 1.2 million yen per year is tax-exempt. The tax-free period of the Accumulation NISA is 40 years, but only up to 400,000 yen per year can be invested.

Savings NISA is suitable for young people as it allows them to build assets by investing for a long period of time.

In my case, 40 years is too long. So I am investing in a general NISA account.

In 2017, it was a taxable account because I didn't know anything about it, but I started to accumulate in a general NISA account in 2018 as I started to understand a little more about how NISA works.

Since I started in 2018, the five-year tax-free period will end in December of this year.

The General NISA has a system that allows you to invest tax-free for another five years if you roll over after the tax-exempt period ends.

If the market value of the rolled-over mutual funds is 1.2 million yen or less, you can accumulate additional funds until the market value reaches 1.2 million yen.

In my case, since I started my mutual fund accumulation small, there is still room in the 1.2 million yen limit even after rollover. Therefore, I decided to take the procedure for rollover.

The government is reviewing the NISA system in order to create a trend away from savings and toward investments.

Although it is not yet clear what the new system will look like, it is likely that the government will extend the five-year term of the general NISA and increase the annual limit of ¥400,000 for the savings NISA.

Personally, there are benefits either way. What I am more concerned about is how long I can keep accumulating.

I feel I don't have much time left.