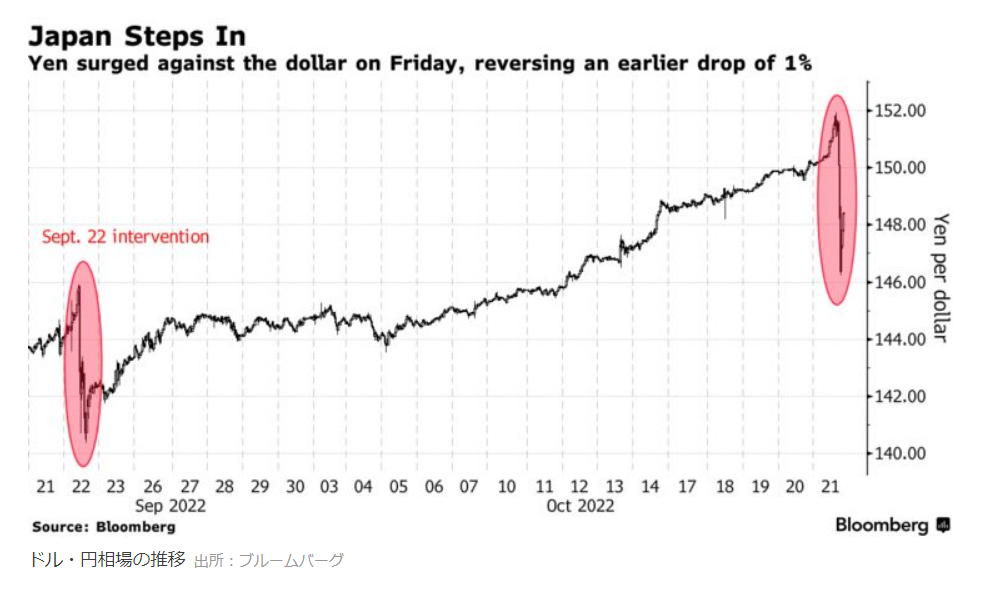

On October 21, the yen crossed the 150-yen per dollar milestone, and in less than a day it weakened to 151.94 yen per dollar.

However, before dawn on October 22, the yen suddenly appreciated to 146.16 yen.

It appears that the Japanese government intervened in the exchange rate, although it has not officially admitted it.

Although the Japanese government intervened on September 22 to strengthen the yen to nearly 140 yen, the yen continued to sell off against the dollar, bringing the price down to its pre-intervention level two weeks after the intervention.

I do not know how many days it will take to return to the original ¥151.94 from this intervention, but we suspect that it will probably take less than 10 days. I have no evidence to support this, but given that the economic and social situation has not changed significantly, the trend of a weaker yen and a stronger dollar is unstoppable.

Although the ban on travel by individuals from overseas was lifted on the 11th and restrictions on the number of people entering the country were removed, it will take time to increase the number of aircraft coming to Japan, so yen purchases by overseas travelers will be limited.

It is financial institutions and FX investors who are most pleased with this currency intervention. If they buy dollars when the yen weakens, they can make a marginal profit because the dollar will appreciate even if the yen is left unchecked. From their point of view, the Japanese government has created an opportunity for them to make a profit for sure.

Given this, what on earth is the significance of this currency intervention?

*There is a theory that the ratio of the monetary base (money supply balance) between two countries provides a rough indication of exchange rate trends. The monetary base is the sum of cash circulating in the market and current deposits held by commercial banks with the central bank.

Japan's monetary base in August was 659.7 trillion yen. The U.S. is 558.2 trillion dollars.

According to this theory, one dollar is 118.18 yen. (659.7 trillion yen divided by 558.2 trillion dollars)

Considering the difference in interest rates between Japan and the U.S., the yen may still be too cheap.