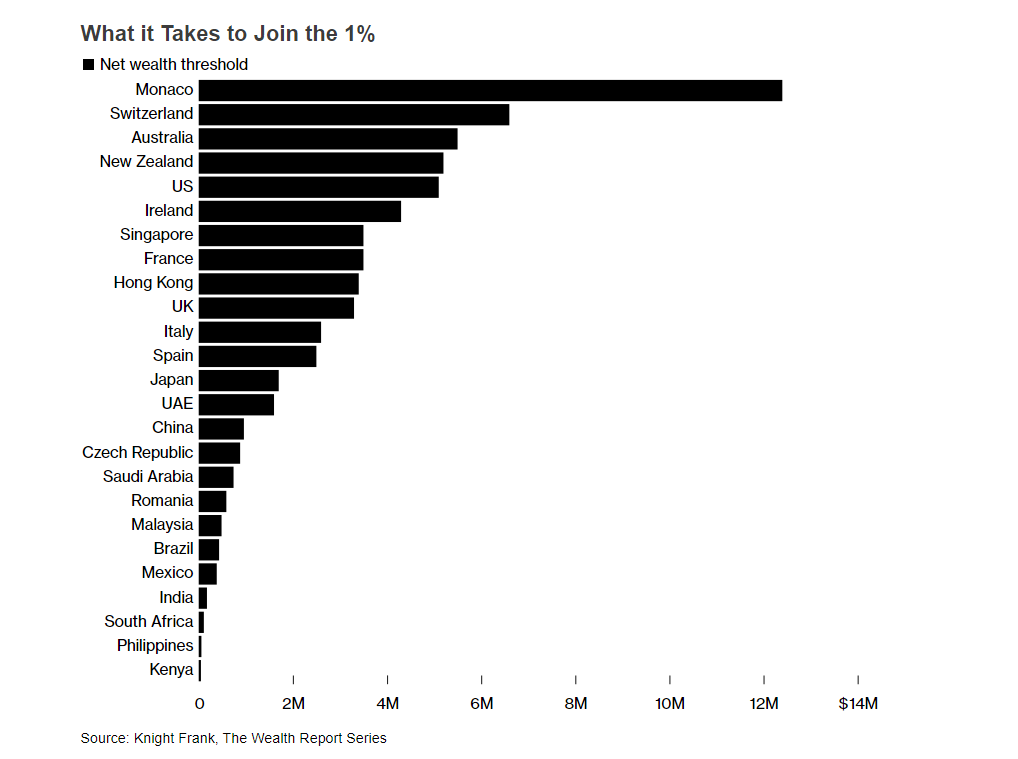

A British real estate consultancy has published some interesting data.

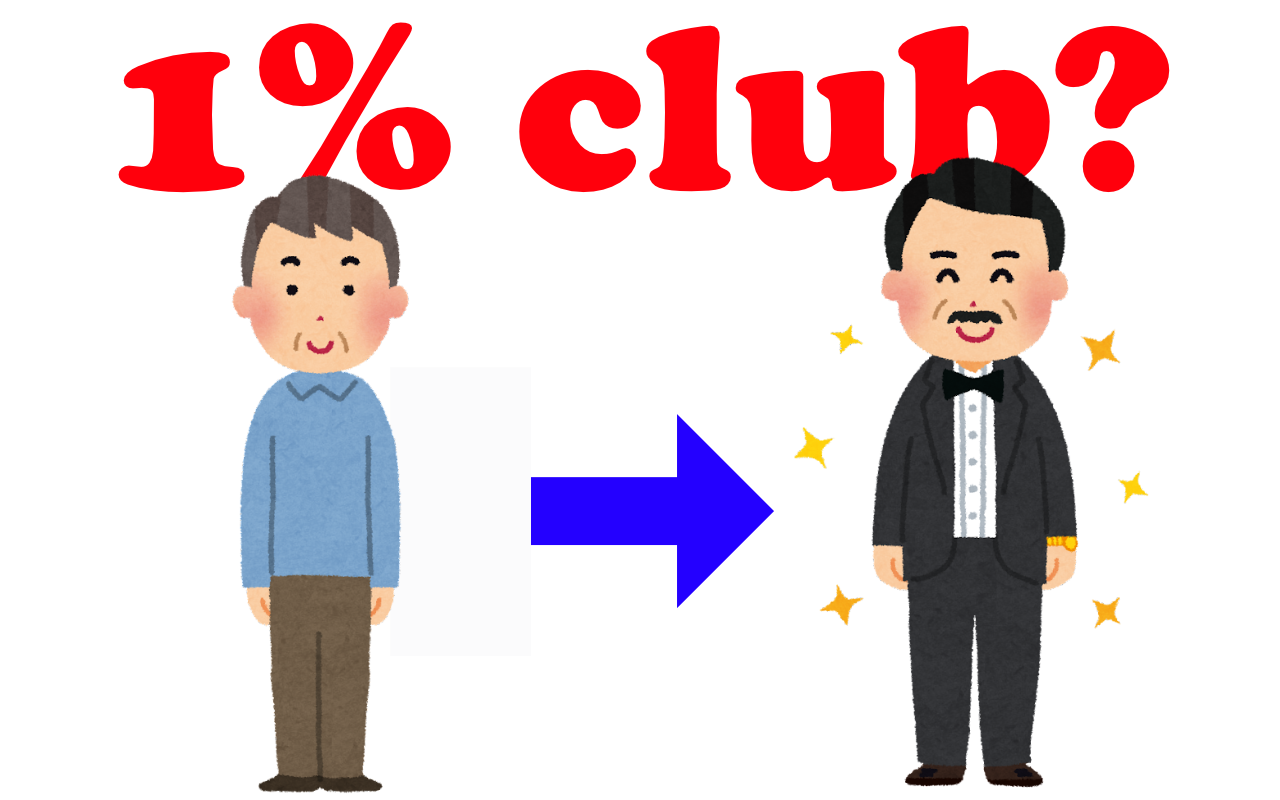

It shows how much financial assets are needed to join the wealthy 1% club in each country.

The highest hurdle was the Principality of Monaco with $12.4 million (1,733.6 million yen; 694.4 million pesos).

It is followed by Switzerland, Australia, and New Zealand. The United States, with its image of millionaires, comes in fifth at $5.1 million (714 million yen; 285.6 million pesos).

Japan dropped a long way down the list to $1.7 million (238 million yen; 95.2 million pesos). The Philippines is at $57,000 (7.98 million Japanese yen; 3.19 million pesos).

*Converted at 140 yen to the dollar and 56 pesos to the dollar

It is impossible for me to join the 1 percent club in Japan, but I can become a member of the 1 percent club in the Philippines.

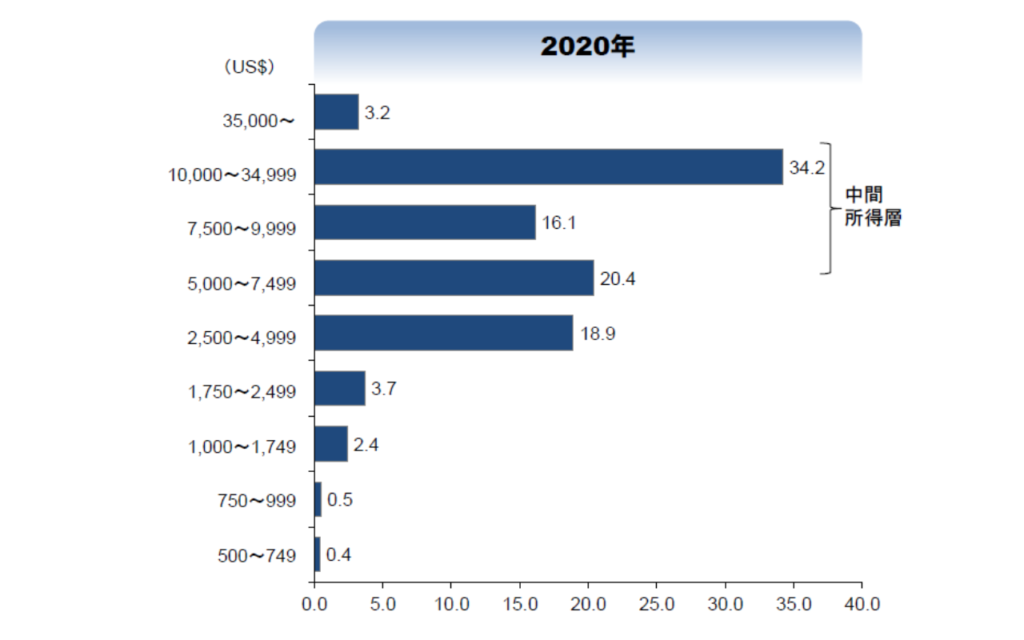

The graph above shows the distribution of annual household income in the Philippines. (From a report by the Ministry of Economy, Trade and Industry)

The annual income of the wealthy in the Philippines is 4.9 million yen, which would make the average Japanese person a wealthy person, but if, like me, their main income after immigration is only a pension, they would likely be in the upper middle income bracket.

While household incomes in Japan are falling every year, household incomes in the Philippines are increasing.

As if to reflect this, real estate prices in Manila and Cebu are becoming as high as or higher than those in Japan's regional cities.

Prices for condominiums in Cebu City range from 8 million yen or more for a 1K (22m2) to at least 20 million yen for a 2DK (55m2). A detached house costs 40-50 million yen. This seems outrageously expensive considering the average wage in the Philippines.

It is said that the dream of the average Filipino is to own a house and a car. As is the case in Japan, not many people buy a house with a lump sum of cash. It is normal to buy a house or a car with a loan.

This is why many Filipinos cannot save enough to repay their loans even if they have income. Filipinos are just like the Edo people, who "don't have any money for the night. Filipinos enjoy the present rather than saving for the future.

Although the Philippines has an annual economic growth rate of 6-7% and income continues to increase, the reason why financial assets have not increased may be because of the nature of the Filipino people.

The low financial assets of working-age Filipinos are not limited to Filipinos; it may be the same for the Japanese. Although the Japanese are said to be savings enthusiasts, their savings are not that large when they buy a house, a car, or send their children to college. In Japan, where wages have remained flat for the past 20 or 30 years, financial assets do not increase visibly until after the child-rearing years are over.

Surveys by the Bank of Japan and other sources indicate that many people increase their financial assets after they reach their 60s, when they are approaching old age.

I am one such person.

My wife is currently building a house in Cebu and plans to buy a car as soon as the house is completed and we move there. Then she will own a house and a car, and her dream will come true.